Schemes features

Our schemes platform is the most intuitive, flexible, cost effective and quickest to market software platform for Insurers, MGAs, Affinities and Brokers with Delegated Authority to administer schemes.

Durell gives general insurance brokers the tools to manage the full policy lifecycle from quote and issuance, through claims and MTAs to renewal.

Flexibility to scale

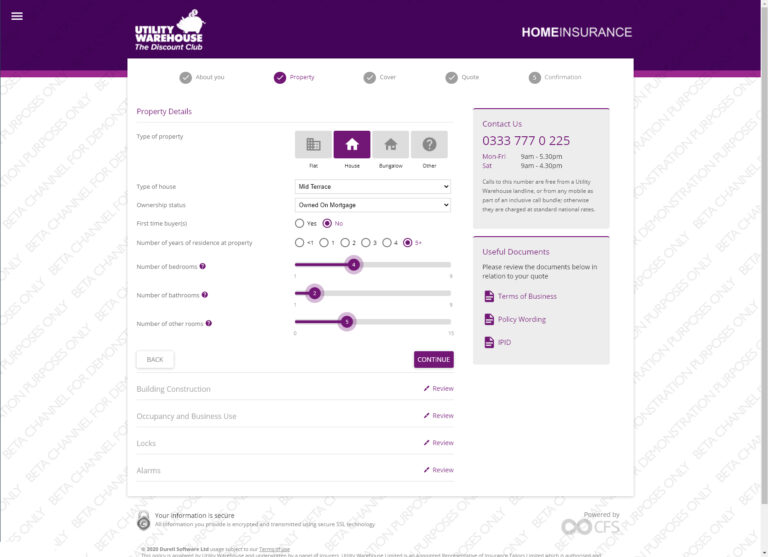

The schemes platform supports B2C (Broker to Client) and B2B (Broker to Broker) sales, language packs with variants for client, broker and underwriter means you can sell to both channels from the same question set.

Open your product to direct sales online, restrict it to registered users, or lock it to your agents only. An Insurer or MGA’s brokers or a broker’s sub-brokers or other introducers can be given access restricted to their own business. Extranet out of the box!

Our robust and powerful API allows quoting on aggregators or integration of your product into other sites and services. Insurer Hosted Pricing out of the box!

Hosted on Amazon Web Services we can scale up capacity at the click of a button.

All the tools you need

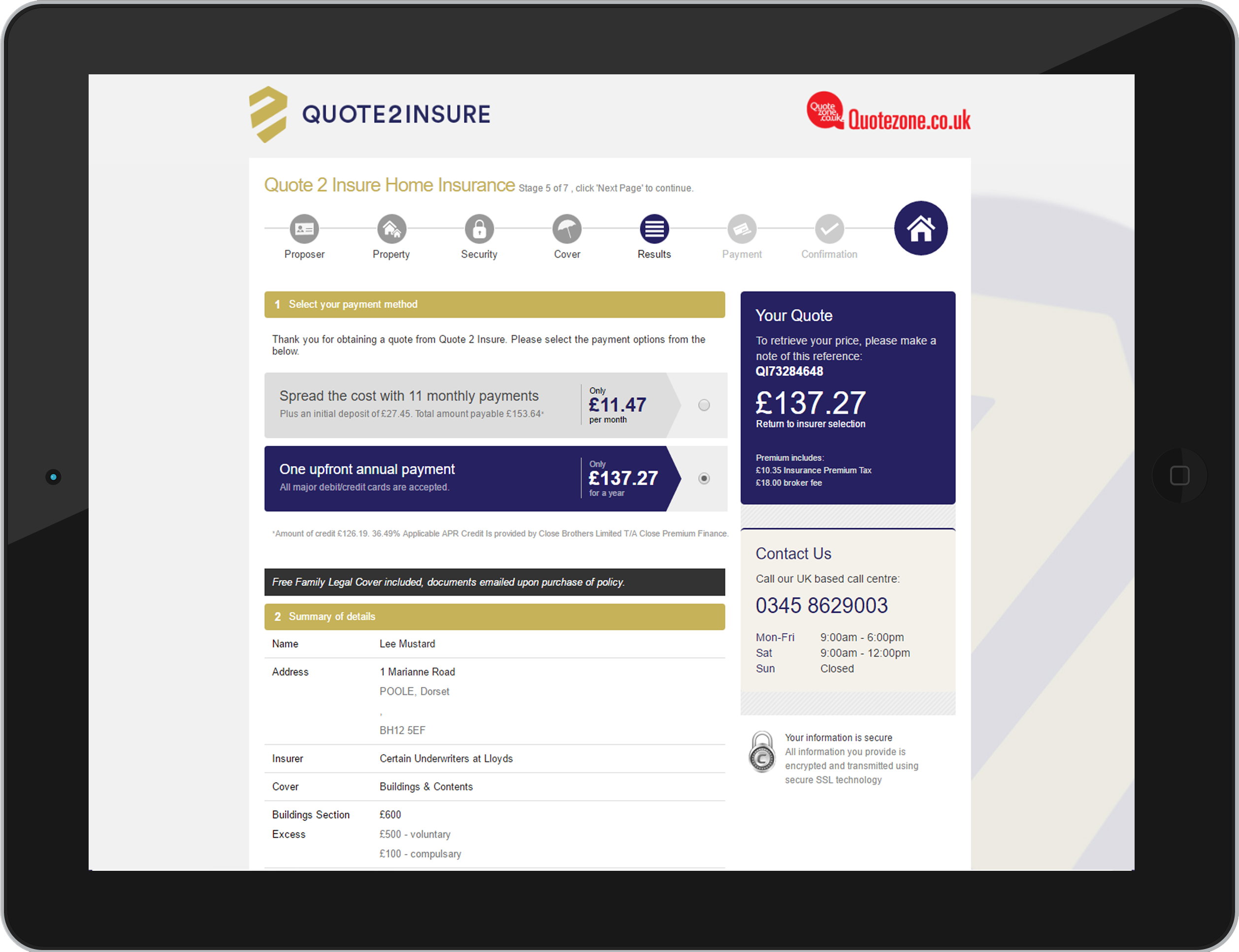

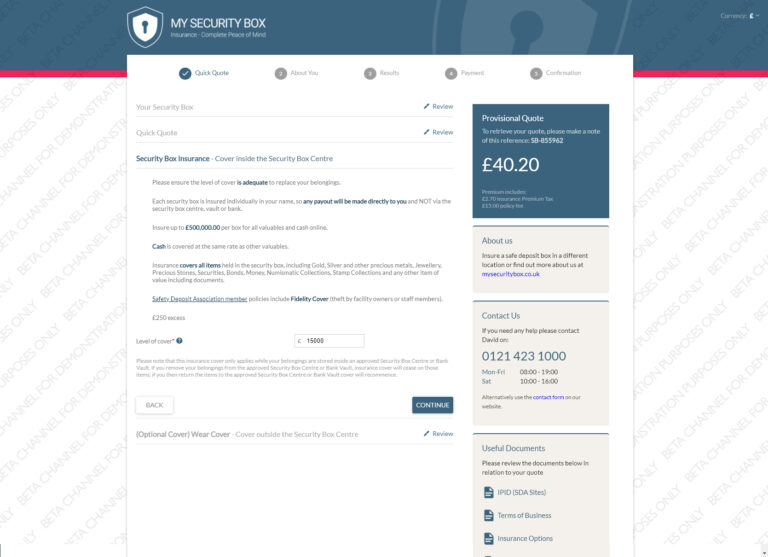

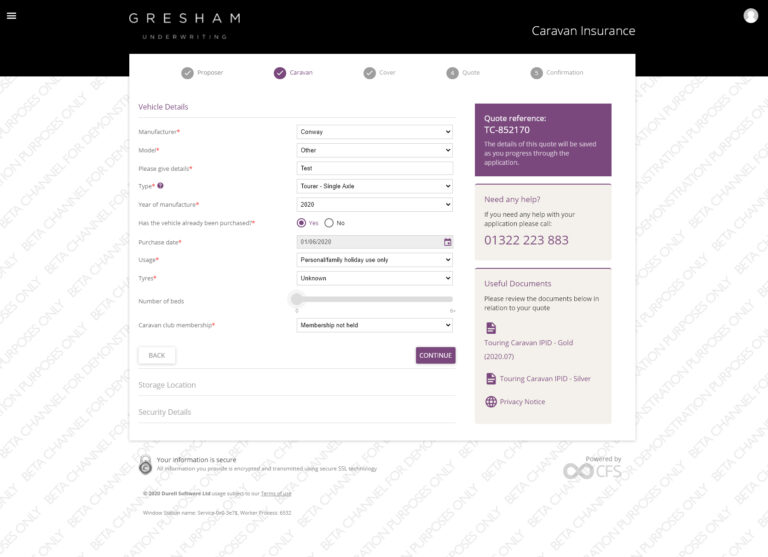

White label online quote & buy, configurable web portal for clients, brokers, insurers and claims handlers.

Complete flexibility of question set, create a bespoke journey for your clients and product.

Quick rate, document and email changes.

Our schemes platform builds on Durell’s 40 years of expertise to provide powerful and flexible tools developed in collaboration with our clients.

Online Platform

Use our schemes platform collection of pre-built web components to easily create a client portal on your website linked directly to your Durell database.

Client Portal

Increase Footfall

Secure Connection

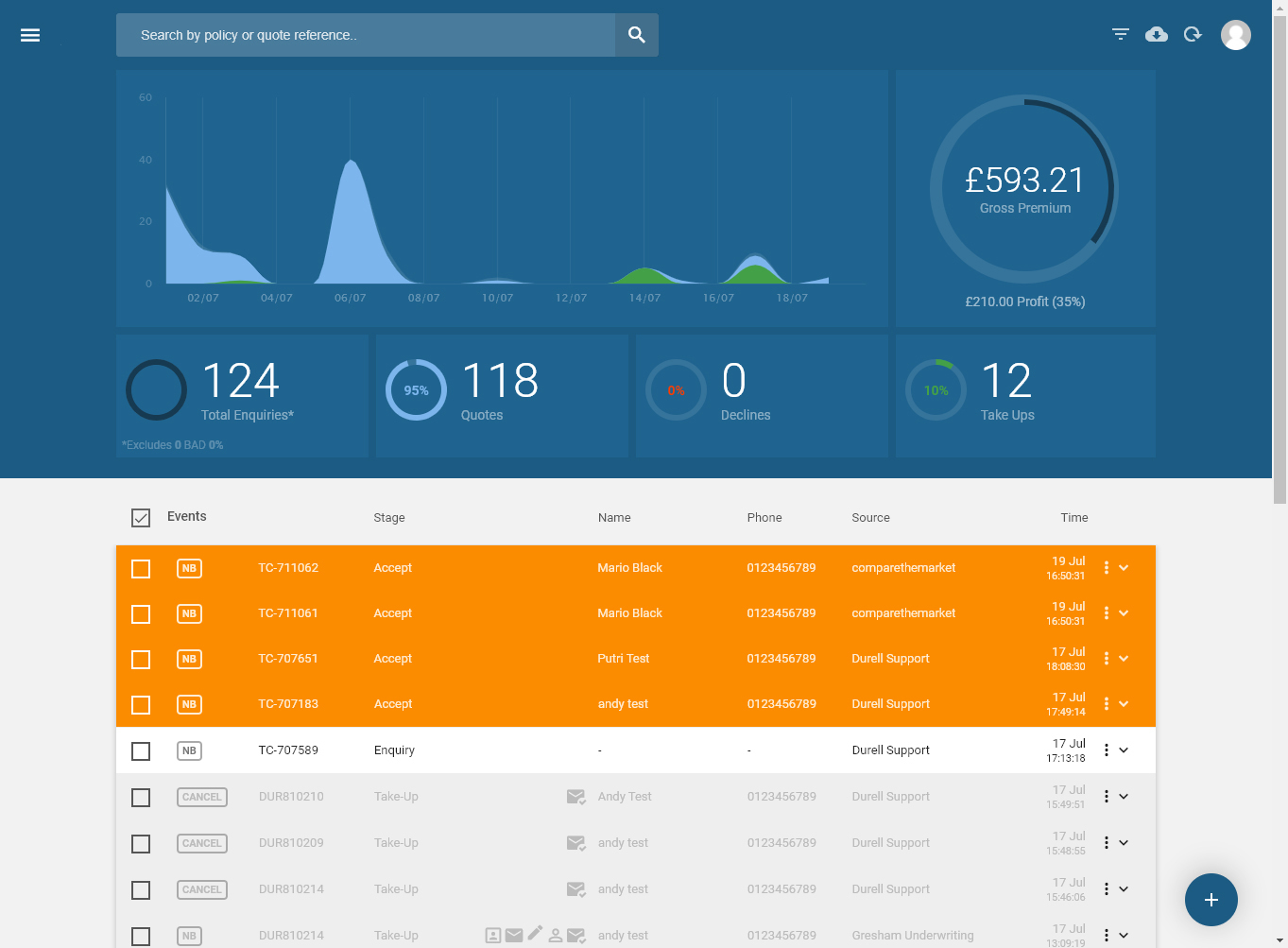

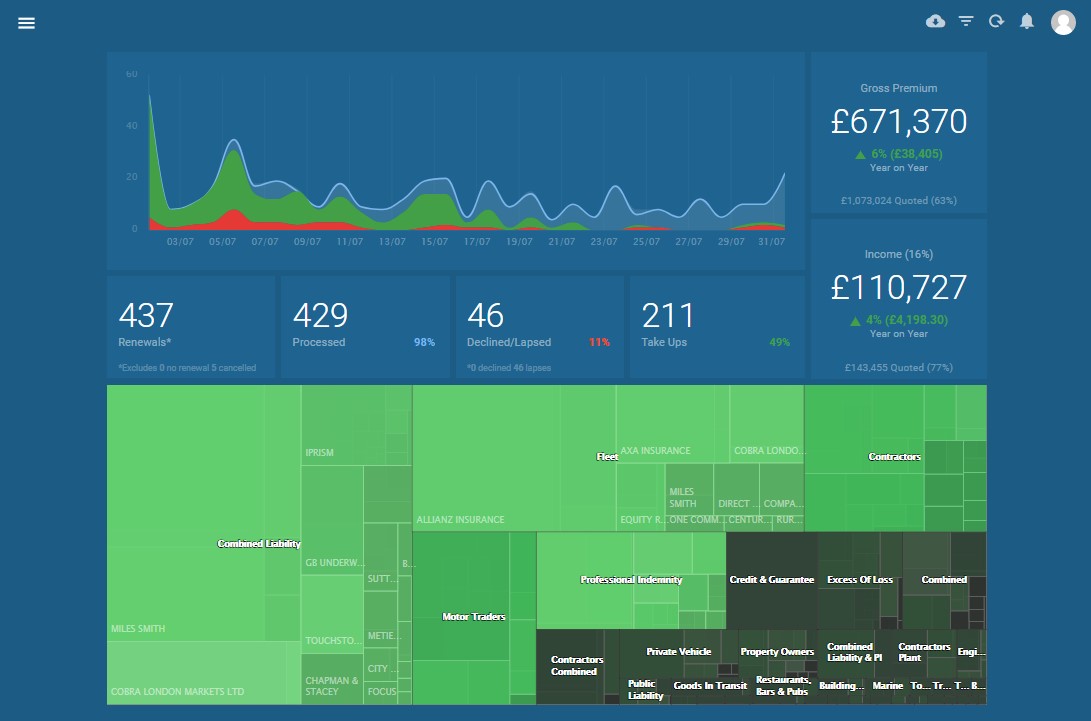

Dashboard

General Broker

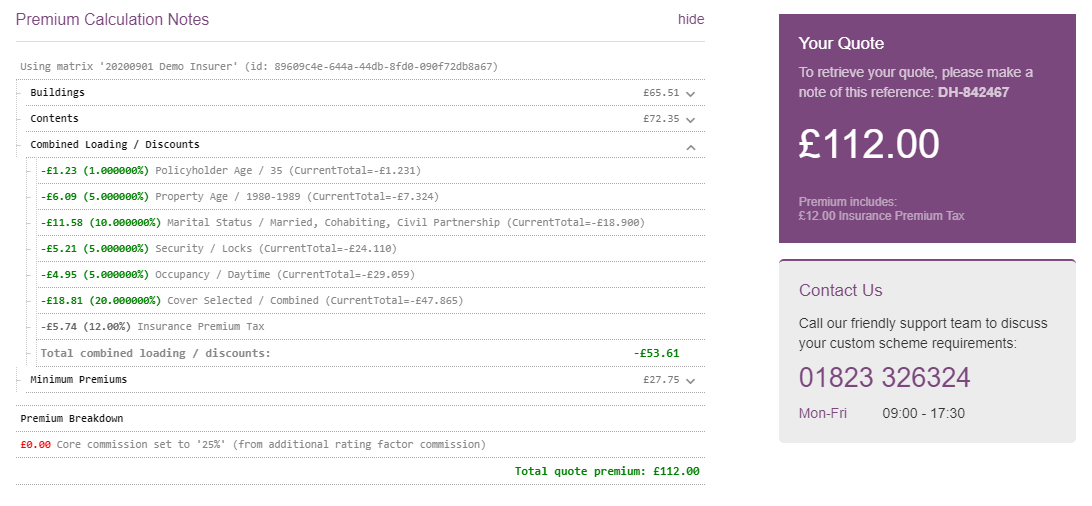

Set up automated trading of your custom scheme with a browse & buy website linked directly to your Durell database. Create a pricing structure that is as sophisticated or straightforward as your scheme requires with Durell’s market leading bespoke quote engine. Take secure online payment by credit card, use the links to Close Brothers Premium Finance or collect Direct Debit instructions. Allow advisers and sub-agents to log in to review their clients’ details and policies

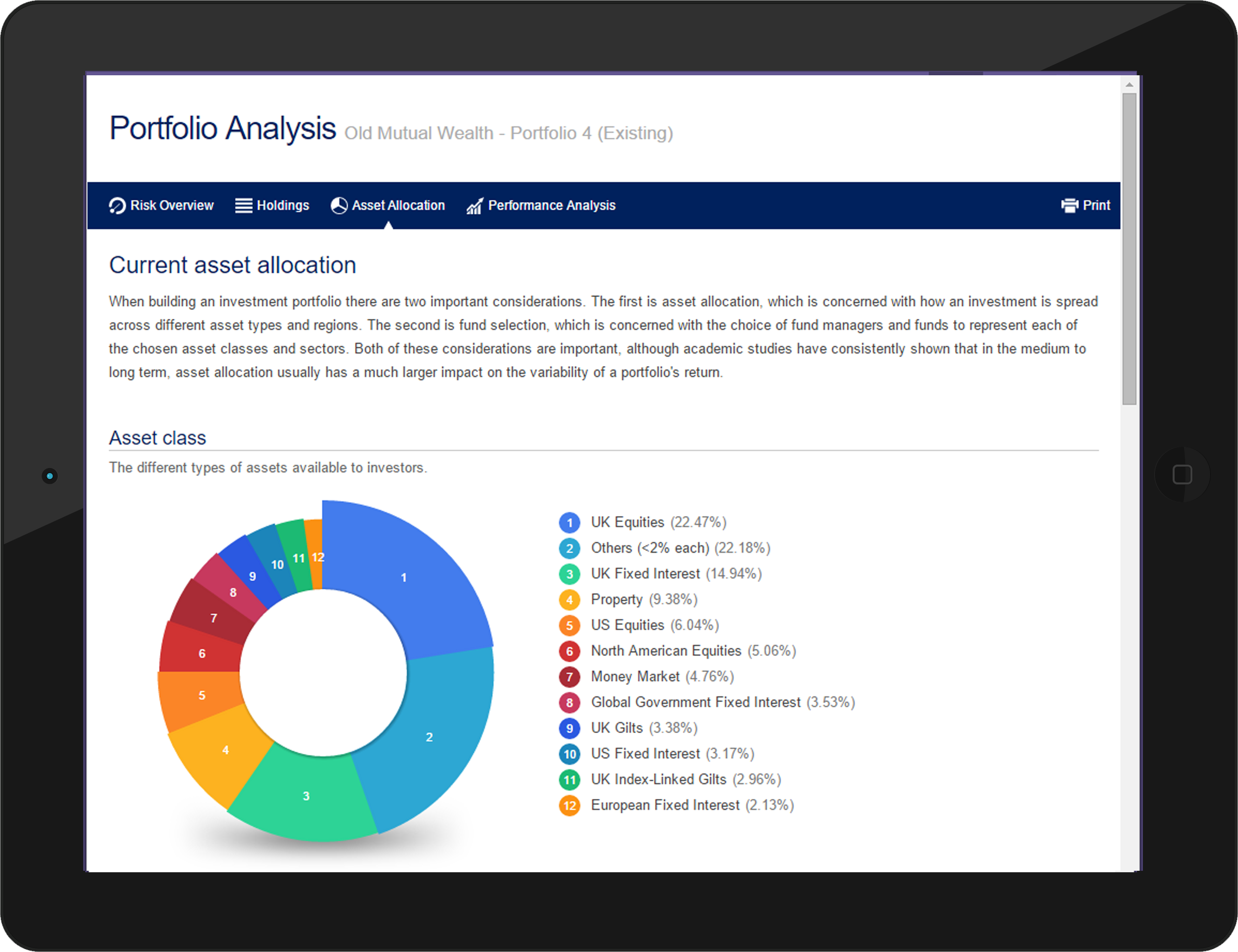

Financial Adviser

Make your reviews more efficient by letting your clients view and edit their Fact Finds online. Provide modern, interactive portfolio valuations to your clients through the client portal. Allow clients to review changes to model-based portfolios online with Durell’s market leading Portfolio Review System and investments strategies to improve their finances using resources as etoro copy trading which is great for people wanting to improve their investment portfolio.

Feature Packed

Scheme admin dashboard

Renewals dashboard

Policies dashboard

MI quilt tool

Bordereau

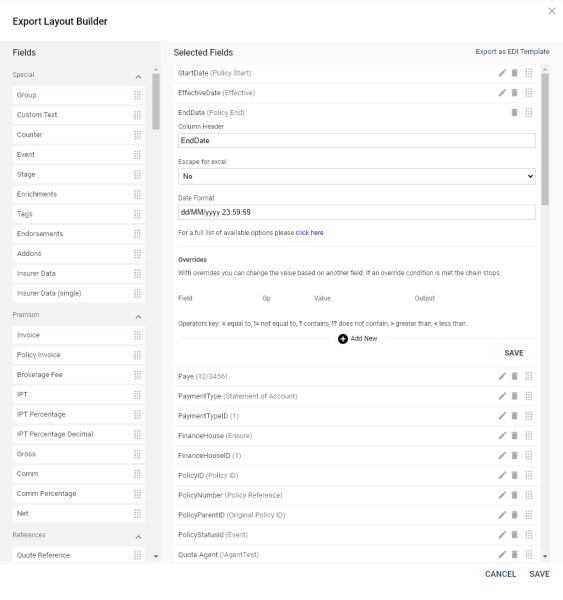

API call

Special field sets

Create report layouts

See some of our schemes features below

Bordereaux capabilities

24/7 Client portal access

Dedicated project manager

Ad hoc reporting

Language packs

Polaris standard ABIs

Direct link to back office

Customisable email templates

Custom reporting for insurers

Bulk renewals

Insurer Hosted Pricing (IHP)

Admin dashboard

Compliance solutions

Quick quote

White labelling

Data Enrichments